DenTek Deal Expands Prestige Brands’ Oral Care Portfolio, OTC Focus

This article was originally published in The Tan Sheet

Executive Summary

While overall oral care sales grow 2.4% in the 52-week period through Oct. 3, sales of the sub-category of floss picks, dental guards, interdental brushes, disposable picks, dental wax, floss threaders, dental picks and tongue cleaners grew 9%. DenTek is first in floss pick sales and second in interdental brush sales.

Prestige Brands Holdings Inc.CEO Ronald Lombardi picks up where his predecessor left off, making an OTC market acquisition, DenTek Oral Care Inc. for $225m in cash, in his fifth month at the helm.

Prestige Brands adds DenTek brand floss, disposable pick and other oral care appliances to its OTC product portfolio and DenTek’s contract manufacturing business in the agreement announced Nov. 23 with DenTek’s owner, San Francisco private equity firm TSG Consumer Partners LLC.

According to Tarrytown, N.Y.-based Prestige Brands, the overall oral care market grew 2.4% in the 52-week period through Oct. 3, but sales of the sub-category of floss picks, dental guards, interdental brushes, disposable picks, dental wax, floss threaders, dental picks and tongue cleaners grew 9%. DenTek is first in floss pick and second in interdental brush sales

In a same-day briefing about the deal, Lombardi says the growth is driven by factors including “increased focus on oral health and greater use of oral care products, highly involved consumers and growing household penetration levels.”

DenTek distributes in the UK, where Prestige Brand also markets products, and in Germany. In October after his first quarter as CEO, Lombardi identified international sales growth as a priority (Also see "Consumer Health Sales And Earnings Roundup: Prestige, GNC, USANA, Omega Protein" - Pink Sheet, 10 Aug, 2015.). The firm’s existing European distribution operations will continue once DenTek’s operations are integrated, though.

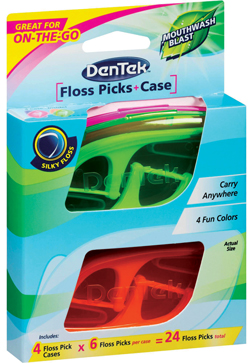

Prestige Brands adds DenTek Oral Care’s DenTek’s Floss Picks in on-the-go packaging, above, Wax For Braces, below, and other oral care appliances to its OTC product portfolio in its $225m acquisition.

“This is going to complement what we've got going on in the UK and double our business there very nicely. We'll continue to look at that distributor and use that distributor model because we think it's very efficient for our business as we look to grow outside of North America,” Lombardi said.

With Maryville, Tenn.-based DenTek’s line, Prestige Brands will have its fifth $100m brand. It expects to close the deal, its sixth since 2010, in the first half of 2016, pending Federal Trade Commission evaluation of potential anti-competitive product overlaps by the firms.

Similar Business, New Products

However, market analysts questioned why Prestige Brands agreed to pay around 9.5 times the adjusted EBITDA that DenTek will add, or around $60m annual revenue and $23m adjusted EBITDA.

Lombardi said the combination of the outlook for sales of floss and other dental appliances and DenTek’s business operations sold Prestige Brand on the deal.

“We've got a very well-defined M&A criteria that always starts with brand building and long-term growth profile. And we think that this is a very good long-term growth opportunity,” he said.

“Similar to Prestige, DenTek with their business model is essentially a sales and marketing and new product company. They have a fairly robust new product pipeline that we'll look to continue to invest behind as well once we close on the business,” added Lombardi, who moved up from chief financial officer to CEO in June (Also see "Industry Roundup: Prestige Brands CEO Change; P&G, Abbott, MJN Earnings" - Pink Sheet, 27 Apr, 2015.).

Adding DenTek also continues Prestige Brand’s move former CEO Matthew Mannelly started toward becoming an OTC product firm. DenTek’s products will increase the OTC part of its product mix from 78% to 80%, closer to its goal of 85%. Prestige Brands calls its other offerings “non-core.”

Oral Care Lineup

With Den Tek’s products, Prestige Brands expands its oral care portfolio, but still without entering the toothpaste market:

- Fresh Guard by Efferdent: cleaner for retainers, mouth guards and other removable braces

- Efferdent Denture Cleaner: for full plate dentures, partials, retainers and other dental appliances

- The Doctor's NightGuard: teeth and jaw protector from the detrimental effects of nighttime teeth grinding

- Gly-Oxide: antiseptic oral cleanser

- Effergrip and EZO: denture adhesives

“We focus on our core OTC brands and the international business for growth,” Lombardi said, adding, “We have made significant progress over the last five years growing from less than 67% growth just a few years ago to 78% and increasing today.”

Prestige Brands’ most recent deal was its April 2014 $750m acquisition of Insight Pharmaceuticals LLC, establishing a platform in feminine care anchored by Monistat yeast infection treatment, Uristat urinary health products and e.p.t. at-home pregnancy test (Also see "In Brief: Prestige Buys Insight, Quarterly Earnings For MJN And Colgate, Bio-Recovery Warned On Claims" - Pink Sheet, 28 Apr, 2014.).

It also acquired the Hydralyte Australian drink brand in 2014 and Australian OTC firm Care Pharmaceuticals Pty Ltd. in 2013.

Ropes & Gray LLP served as legal counsel and Houlihan Lokey served as financial advisor to the sellers.