Innovation Pays: Priority Drugs Drove Novel 2011 Approvals To New Heights

This article was originally published in Pharmaceutical Approvals Monthly

Executive Summary

The new molecular entity and novel biologic class of 2011 isn’t just the largest since 2004 – CDER also posted near-perfect on-time review performance while maintaining healthy rates of first-cycle approvals and a low 15 month average time to approval, thanks to a high level of innovation in the novel product candidates.

FDA’s tally of novel approvals in 2011 is impressive, as early trends predicted, but the agency’s consistently strong performance on a range of review metrics shows that improvements in review performance ran deep.

FDA has been trumpeting the 30 new molecular entity and new biologic entity approvals from CDER in 2011 – the most since 2004 and a welcome sign of recovery after the approvals doldrums in between – but the agency also deserves recognition for achieving an unprecedented, near-perfect rate of PDUFA review goal compliance (96.7%) while maintaining healthy rates of first-cycle approvals (63.3%), and time to approval (an average of 15 months) (see full listings of NME and NBE approvals, (Also see "New Molecular Entities Approved In 2011" - Pink Sheet, 9 Jan, 2012.) and (Also see "Biologics Approved In 2011" - Pink Sheet, 9 Jan, 2012.)).

|

CDER Review Performance In The PDUFA IV Era |

|||||

|

Year |

Approvals (average time to approval) |

User fee compliance |

First-cycle review share |

First-cycle share, Standard |

First-cycle share, Priority |

|

2011 |

30 (15 mo.) |

96.7% |

63.3% |

43.8% |

85.7% |

|

2010 |

21 (15.1 mo.) |

86% |

76.2% |

75% |

77.8% |

|

2009 |

25 (17.3 mo) |

72% |

58% |

47% |

66.7% |

|

2008 |

24 (17.9 mo.) |

70% |

67% |

53.3% |

88.9% |

Consistency is becoming a hallmark of FDA’s review activity, with nearly identical average times to approval in the two years following the adjustment period for implementation of the FDA Amendments Act. The striking difference between 2010 and 2011 is the number of approvals, not the parameters of the reviews – showing FDA can deliver the same performance with a higher volume (Also see "Few, But Fast And On Time: 2010 Saw Low NMEs, But Almost All Were First-Cycle Approvals And FDA Met Most User Fees" - Pink Sheet, 1 Jan, 2011.).

As a more biologically-oriented pharma industry has evolved, the level of therapeutic biologic submissions appears to have settled into a groove; in each of the past three years, CDER has approved six therapeutic biologics, representing in the neighborhood of one-quarter of all CDER approvals for each year.

CBER, with far fewer therapeutic approvals, joined in the solid review performance, meeting user fee goals for all three of its novel biologic approvals in 2011 – the second time the biologics center has posted a 100% rate of PDUFA goal compliance in recent years. The 2011 CBER tally of 3 was, however, a significant fall-off from the 6 BLA approvals in 2010, 9 in 2009, and 7 in 2008.

Reaping The Regulatory Benefits Of Innovation

Innovative drugs drove the positive review trends, with 12 first-in-class agents among the CDER NMEs and NBEs, representing 40% of calendar year 2011 approvals.

FDA has been spreading the message about the high level of innovative approvals in its public communications, helped by a front-loaded user fee calendar that produced a stunning 20 NME/NBE approvals at mid-year (Also see "FDA Sets A Fast Pace Of Novel Approvals In First Half, But That's Likely To Slow" - Pink Sheet, 1 Jul, 2011.). Especially with PDUFA reauthorization on the horizon in 2012, good news was welcome, and FDA used the latter months of 2011 to promote the innovation storyline. A report on “innovative drug approvals” issued at the end of the fiscal year helped to get FDA in front of the inevitable year-in-review discussions (Also see "FDA Initiatives To Expedite Reviews Pay Off In FY’11 Approvals" - Pink Sheet, 1 Nov, 2011.).

First-in-class status correlates closely but imperfectly with priority review status, another marker of innovation that incorporates not only pioneer mechanisms but also unmet medical needs. By the metrics, the 2011 class did not vary significantly from the level of innovation in recent years, though the significance of some of the innovative products cleared in 2011 certainly makes the class notable.

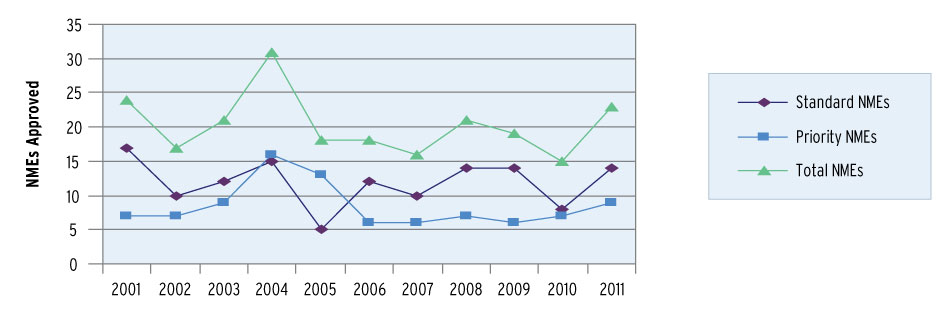

A Decade Of New Drugs: NME Approvals 2001-2011

FDA; Pharmaceutical Approvals Monthly

Fourteen of the 2011 CDER approvals were designated priority, a 46.7% rate that is just slightly above the first-in-class percentage. Both measures put the share of innovative drugs in CDER solidly in 40th percentile range, consistent with most years of modern CDER – outside the outlier high of 75% priority approvals in 2005 and the low of 30.8% in 2009.

Priority review is historically associated with more first-cycle approvals, and faster reviews, than standard NMEs/NBEs. CDER approved only two more standard review novel products than priority review drugs in 2011 – 16 vs. 14 – but the priority review drugs were almost twice as likely to receive approval on the first review cycle.

Only two priority review approvals received a “complete response” letter, for an 85.7% rate of first-cycle approvals in the 2011 CDER priority approval cohort. Only 43.8% of the standard approval group received a first-cycle approval; nine of the 16 standard NMEs/NBEs went to a second review cycle. The divide is the largest in the PDUFA IV period of 2008-2011.

The Value Of A First-Cycle Approval

The difference in time to approval between the first-cycle and second-cycle approvals is stark. On average, the penalty for going to the second review cycle was 19.6 months, the difference between the 7.8 month average time to approval for all NMEs and novel BLAs (CDER and CBER) approved in one review cycle and the 27.5 month average for products requiring two review cycles.

Given the considerable difference between one- and two-cycle approval times, the desirability of meeting the PDUFA goal date for action on an application may be less desirable for a sponsor than avoiding a “complete response” letter, which carries an inevitable administrative workload in addition to any required investigations. For the one CDER-reviewed 2011 approval that missed its PDUFA goal, the additional three months of “overtime” allowed FDA and the company to work out a way around a late-emerging problem; the alternative, moving to a second cycle, could well have meant a second trial.

In general, a high rate of first-cycle approvals helps to drive the average time to approval lower. For example, in 2010, a very high 76.2% first-cycle rate contributed to a relatively low average approval time at 15.1 months. But in 2011, similar performance was achieved despite a lower first-cycle approval rate. In 2011, a first-cycle rate more than 10 percentage points lower produced an ever-so-slightly shorter average time to approval of 15 months – thanks largely to the unusual number of very short reviews.

While the average time from submission to approval in 2011 does not match the record-low times for the modern CDER (responsible for both drugs and therapeutic biologics since the end of 2003) set in 2005 and 2007, it should be noted that those years featured very low approval totals. While 2005 saw a 13.5 month average time to approval, CDER only approved 20 NMEs and therapeutic biologics that year. In 2007, the 12.3 month average time to approval drew from a base of just 18 approvals. Achieving the third-lowest average time to approval of the modern CDER era while approving a high of 30 agents is even more impressive in that context.

The Long And The Short Of The Class Of 2011

While the 2011 approval cohort is unusual in containing no approvals that required three or more review cycles, it did have a large number of long reviews, or products that required two years or more to reach approval. Five CDER approvals and two CBER approvals went beyond the 24-month mark; in 2010, only two CDER and one CBER review exceeded 24 months. Lengthy times to approval were seen in four 2009 approvals and, matching the 2011 number, in seven 2008 approvals.

Five of CDER’s 2011 approvals came in under six months, compared to only one (in 5.9 months) in the last three years.

At the other extreme, 2011 had an unusually high number of very short reviews, or approvals that came in less than the six-month time frame allotted to priority reviews. Five CDER approvals came before the priority user fee goal, all of them for cancer drugs. In 2010, in contrast, only one application was approved very quickly – and that was just under the wire at 5.9 months. No approvals in 2009 or 2008 came in less than six months.

With more than half the oncology approvals coming in advance of a priority review PDUFA goal, the average time to approval for new cancer drugs in 2011 was only 6.8 months.

Short reviews are just one aspect of the banner year for cancer drugs at FDA. FDA cleared eight oncologic NMEs and NBEs in 2011, outstripping the three novel oncologics approved in 2010, five in 2009, and two in 2008. All eight 2011 oncology approvals received priority review and all were cleared in one review cycle. Six of the eight (75%) were first in class; indeed, oncology drugs accounted for half of the first-in-class approvals for the year.

A similar dynamic, on a smaller scale, is apparent in the second-largest category of novel approvals in 2011: anti-infective drugs. FDA approved four NMEs in an average of 7 months from submission to approval. Three of the four were designated priority applications, including the two novel hepatitis C virus therapies.

Big Pharma/Little Pharma

Big pharma succeeded in returning in force to the approvals table in 2011 after time when NME/NBE lineup was dominated by specialty firms and specialty products (Also see "The Return Of Big Pharma? 2011 Novel Approvals Could Show Payoff Of Licensing And Acquisition Strategies" - Pink Sheet, 1 Feb, 2011.). In 2010, big pharma produced only five novel approvals, led by Novartis AG with two. The big pharma share of CDER and CBER novel approvals in 2010 was only 17.9%; the share for 2011 climbed to 48.5% – almost half of novel approvals.

Big pharma’s presence in the 2011 approval count is broad but thin. GlaxoSmithKline PLC and Johnson & Johnson – two of the triumvirate of big pharma sponsors perennially at the top of the NME count, alongside Novartis – each posted three approvals, while Bristol-Myers Squibb Co. had two orphan therapeutic biologics and AstraZeneca PLC made it back to the market with two NMEs after a considerable drought. Merck & Co. Inc., Pfizer Inc., Roche and Novartis each had one novel approval. Additionally, Eli Lilly & Co. co-promotes Tradjenta (linagliptin), an anti-diabetic from mid-sized pharma Boehringer Ingelheim GMBH.

The largest sector of the big pharma approvals is a specialty market – oncology – where big pharma sponsored five novel products and four of the approvals were for rare cancer indications.

In the burgeoning anticoagulant space, where extensive clinical trial needs require deep pockets, both approvals came from big pharma sponsors: AstraZeneca for Brilinta (ticagrelor) and the team of J&J and Bayer AG for Xarelto (rivaroxaban). Even given experienced sponsors, both NDAs required two review cycles – an indication that the crowding of the field has increased development hurdles.

Notwithstanding big pharma’s 2011 performance, FDA is preparing for an increased role for new and boutique firms. “The new drug research and development paradigm is shifting rapidly from traditional big pharma to venture capital backed small companies,” Jenkins said at Elsevier Business Intelligence’s FDA/CMS Summit in December. Planning for PDUFA V aims to address some of the areas of strain between the agency and small companies bringing their first drug to market through new communication mechanisms (Also see "Emerging Sponsors And FDA: Will Better Communication Under PDUFA V Ease Inherent Tensions?" - Pink Sheet, 2 Jan, 2012.).

In 2011, emerging sponsors accounted for one-third of NMEs approved. Small specialty firms that already had drugs on the market, like Forest Laboratories Inc., EUSA Pharma, and CSL Behring, bring the share of NME/NBEs involving a small firm to over half (some, like Human Genome Sciences Inc., worked with a big pharma partner).

Consistent Performance & Consistent Flexibility

FDA could not have posted a good year for new drug approvals without plentiful applications based on well-constructed clinical programs – an aspect in the hands of industry. But the agency can also make its own luck. The case studies of drug approvals published each month by Pharmaceutical Approvals Monthly suggest that the agency will show great creativity and flexibility in analyzing and acquiring data for new products that address unmet medical needs (Also see "FDA’s Regulatory Flexibility On Display In Review Of Innovative Agents" - Pink Sheet, 1 Dec, 2011.).

The reforms of the FDA Modernization Act necessitated a learning curve for review staff, which Jenkins accommodated by temporarily relaxing expectations. But with expectations for review performance back in force for two full years now, the agency has posted two years of consistently solid performance on the variables that it has a greater degree of control over, particularly on-time reviews and first-cycle approvals.

As the agency heads into PDUFA reauthorization, FDA’s review success will be a powerful argument that the agency knows what it is doing. Just look at the numbers.